STAND NUMBER: C172

MEO-Business

Take Control of Your Processes and Streamline Your Business

When it comes to staff expenses, everyone has an opinion. The staff who are making the claims find the process of working out their mileage, finding those lost receipts and submitting their expenses claims to be one of the jobs that is be put off for as long as possible.

For the managers, these claims come flooding in all at the same time, and at the last minute, with the constant question of `Have you approved my claims yet?`.

The finance team, too, have their pressures. Chasing those expenses, matching up receipts, establishing VAT that can be reclaimed, filtering out the rechargeable expenses, ploughing through credit card statements to match up expenses, checking and validating mileage claims, and finally processing and inputting all this data into spreadsheets to produce a form of readable report for management, as well as processing those repayments back to the staff.

Delays that mean missing the deadline for making expense payments mean that expense claims may go unpaid for another month, with the employee feeling that they are acting as an overdraft for the business.

Sounding familiar?

This monthly process summarises the nightmare faced by so many staff and finance teams, which is caused by inadequate systems and processes, which may have worked well years ago, but are no longer equipped to handle the pace today. Unfortunately, this process has also become the new normal, and many are unaware that there is a far simpler and less time-consuming way to manage expenses, which won`t strike fear whenever month end approaches.

Moving to an expense management system

With MEO-Business.MyExpenses, claimants can submit claims anytime and anywhere, with receipts being photographed and read using our OCR technology. Mileage claims are accurate, with GPS location tracking or postcode entries. You can even setup a link to your diaries if you need.

Managers find that our flexible, authorisation is a breeze, with the complexity of who is approving and when taken care of automatically. One click does it all.

Finance teams can save time as there is no double-entry, claims are validated and confirmed to be in policy automatically. Reclaimable VAT is calculated, even if you have some specific VAT rules.

Claims can be reviewed without trawling through a paper mountain, with export files generated for entry into all major finance, ERP, payroll or BACS systems.

All available on any web browser or your iPhone and Android devices.

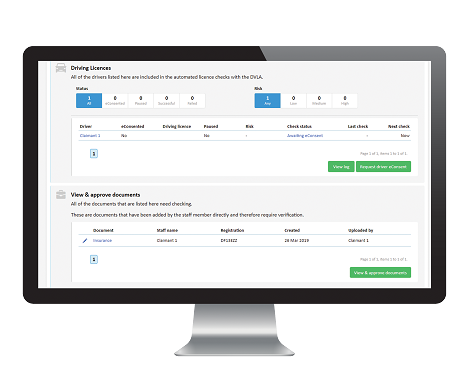

DriverCare, our latest edition to or portfolio of software enables companies to automatically check driving licences and vehicle tax & MOT details to maintain a safe fleet.

It allows you to focus on your core business without worrying about your drivers compliance.

As most accidents at work occur whilst driving, checking that every employee has a valid driving licence, business insurance and that the vehicle is safe and roadworthy is essential.

If an accident occurs, failure to show that you have taken every necessary

precautions to ensure employee safety could be seen as negligence and lead to

expensive litigation costs.

We make it as simple as possible for employees to provide you with all the

relevant information you need to ensure your compliance.

DriverCare helps you to stay compliant while efficiently managing your fleet and drivers. It can meet the needs of your company fleet, a grey fleet or a combination, with the ability to check tax and MOT and automatically keep this up to date. Insurance documents can also be stored and checked through the system. Drivers can be verified and risk managed with driving licence checks for current endorsements, penalty points and convictions all of which is automated.

Our system is directly linked to the DVLA and results are received instantly. Check frequency can be selected depending on driver risk level.

Why not try our software for FREE!?